Using predictive models in engagement strategies

Introduction

A predictive model is used to predict customer behavior such as offer acceptance and churn based on characteristics such as credit risk, income, product subscriptions, etc. Learn how to arbitrate between different groups of actions to display more relevant offers to customers. Gain experience using a predictive model in a decision strategy and learn how applicability rules can be defined to reflect the bank’s requirements in a decision strategy.

Video

Transcript

This demo will show you how to use a predictive model in an engagement strategy to determine customer applicability for a retention offer.

Currently, U+ Bank is doing cross-sell on the web by showing various credit cards to all customers who log in to their website.

The bank now wants to show a retention offer, instead of a credit card offer, to customers who are likely to churn in the near future. The credit card offers will only be shown to loyal customers.

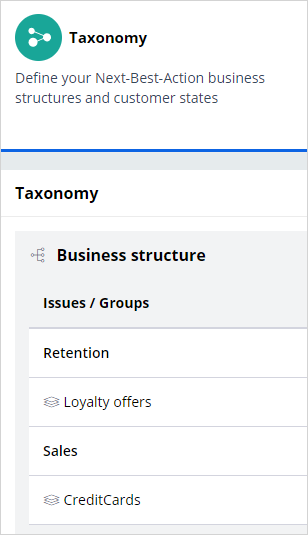

To meet this business requirement, a decisioning administrator has already set up the new business structure by defining a new Issue/Group, the Retention/Loyalty offers under Taxonomy.

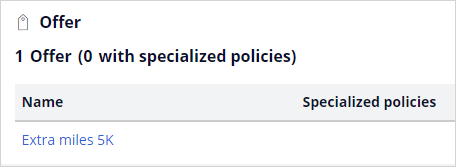

The retention offer, Extra Miles 5K, has also been created for this issue/group.

The next step is to create an applicability condition that makes a customer qualify for a retention offer when there is a churn risk. Since the churn risk is predicted using a predictive model, you need to use a decision strategy to define this condition.

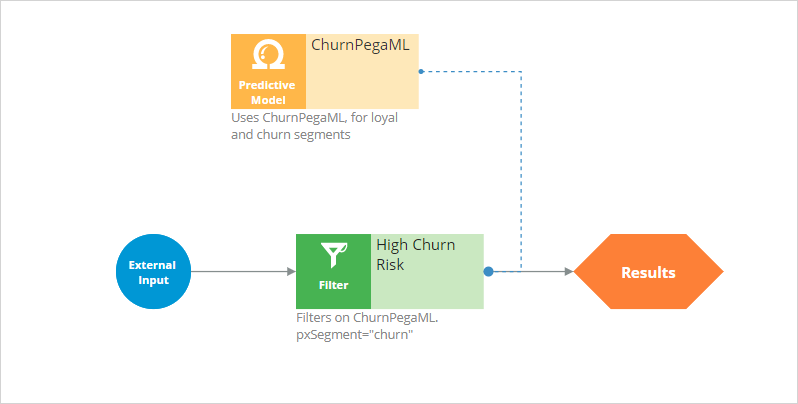

A decisioning administrator has already created the RetentionStrategy. You can use this strategy as basis for the applicability condition.

A data scientist has already created the predictive model using Pega’s built-in machine learning capabilities to identify the customers who are likely to churn in the near future.

To use the predictive model in the decision strategy, add a predictive model component to the canvas and configure it to reference the model. Note that this list contains all the predictive models that are available in the system. These include models created using Pega machine learning, imported PMML or H2O.ai models, and externally executed models built in Google ML or Amazon SageMaker.

Select the desired predictive model from the list.

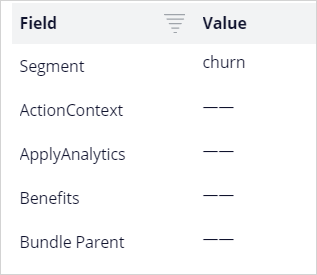

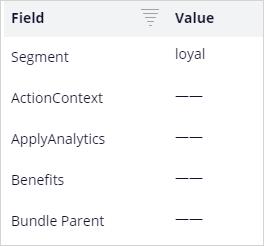

When you open the predictive model, notice that in the Classification groups section, the classes are divided into two groups, and their results are labeled “loyal” and “churn” to predict customer behavior.

You can now use a filter component to express the condition under which the retention offer is applicable.

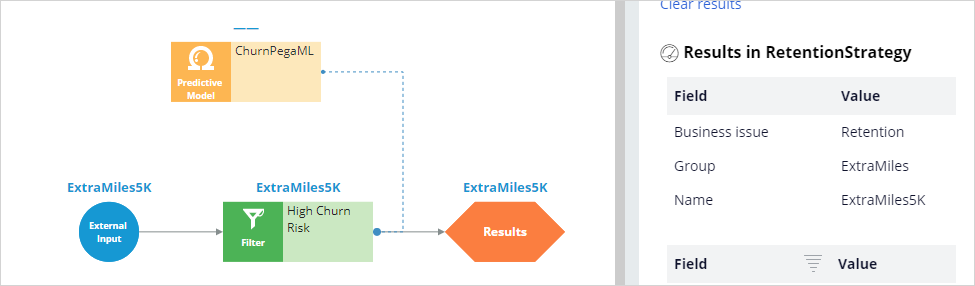

You want this strategy to output a retention offer only if the result of the predictive model is “churn”. The result of the predictive model is stored in the pxSegment property.

Therefore, define the filter condition to output a retention offer for which the pxSegment property is equal to “churn”.

Save the strategy.

Now, test the strategy using the customer profiles, Troy and Barbara.

For external inputs, consider all available retention offers.

The strategy outputs a result for Troy because the result of the predictive model is "churn".

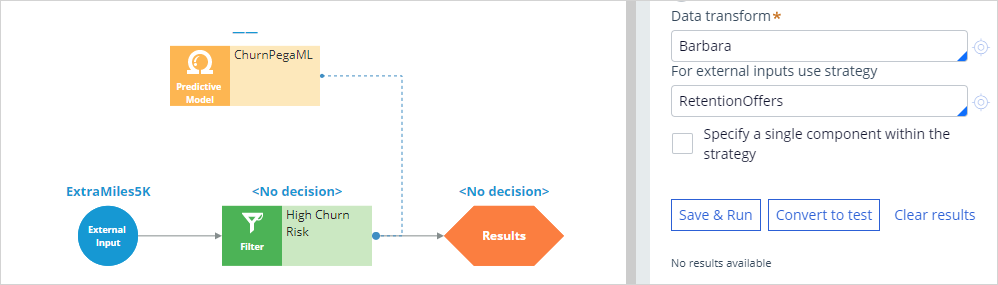

Now, repeat the test to verify results for the Barbara data transform.

The strategy does not have a result for Barbara, because the Segment value is "loyal".

The strategy is not available to the U+ website. By checking it in, you are committing your changes, so they will be put into effect.

You can now use this strategy in the Next-Best-Action Designer engagement policy as an applicability condition for the Loyalty offers and CreditCards groups.

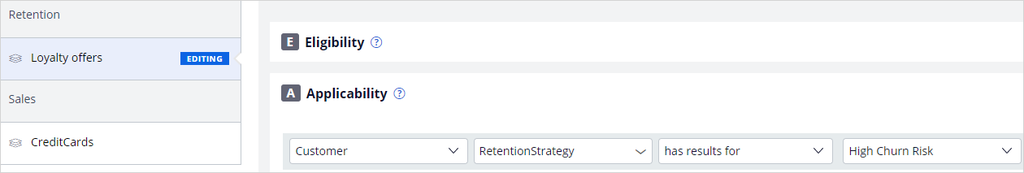

The first business rule you need to implement is: the Loyalty offers group is applicable only for high risk customers. To implement this rule, in the Applicability section, define a condition for the customer field.

Select Strategy and then select RetentionStrategy. The condition is: RetentionStrategy has results for the High Churn Risk.

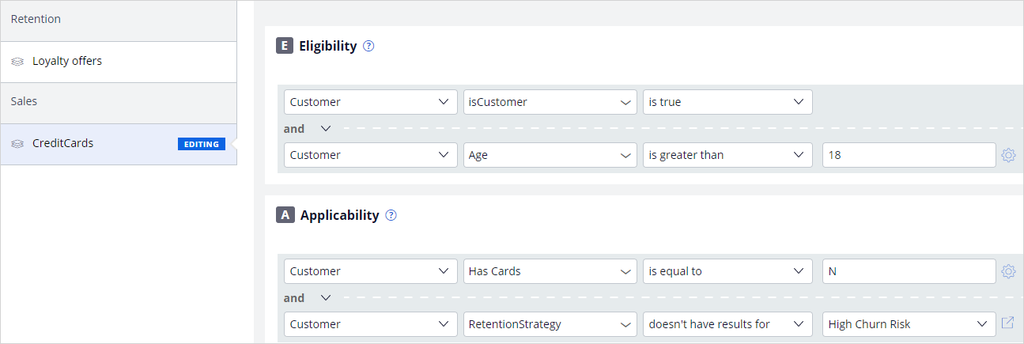

The second business rule you need to implement is: U+ Bank wants to show credit card offers only to customers who remain loyal for now; meaning the CreditCards group is not applicable for high risk customers.

To implement this rule, modify the Applicability section of the CreditCards group.

Select the RetentionStrategy. The condition is: RetentionStrategy doesn't have results for the High Churn Risk.

Save the configurations.

Once the applicability conditions are defined, you need to amend the channels configuration. Since U+ Bank introduced a new group, Loyalty offers, which belongs to a new business issue, Retention, you need to select the results from the appropriate business structure level. In this case, the bank wants to arbitrate between two different business issues: Sales and Retention. Therefore, select All Issues/All Groups from the business structure level.

Saving this completes the required configurations.

On the U+ bank website, when you log in as Troy, notice that the retention offer is displayed. This is because Troy is predicted to churn in the near future.

Now, when you log in as Barbara, notice that the credit card offer is displayed because she is predicted to remain loyal for now.

This demo has concluded. What did it show you?

- How to use a predictive model in a decision strategy.

- How to arbitrate between different groups of actions to display more relevant offers to customers.

- How to define applicability rules using a decision strategy in Next-Best-Action Designer.

Want to help us improve this content?