Pega Customer Journeys

Customer journeys are a sum of the experiences that your customers go through while interacting with your enterprise. Rather than reviewing only part of an experience or transaction, the customer journey documents the full customer experience.

Video

Transcript

Industry standard customer journeys are used to script the customer experience, which often results in a customer getting stuck on a path of offers that does not lead to a relevant outcome. Pega Next-Best-Action Customer journeys take a transformational approach to the industry standard tool that are the customer journeys.

Pega customer journeys and actions in them are prioritized using real-time AI, which provides you the following benefits:

- Allows you to build meaningful customer journeys

- Stays true to the Next-Best-Action paradigm

- Delivers a more relevant customer experience

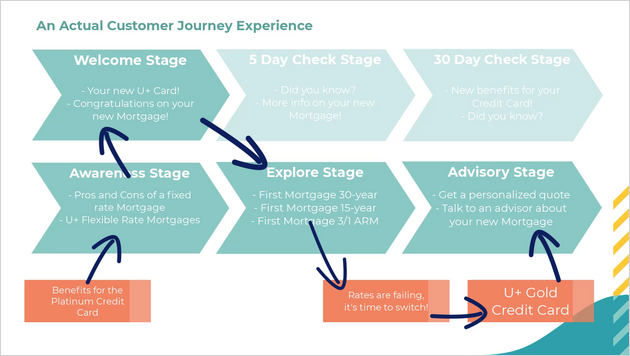

With Pega customer journeys, customers might find themselves in multiple journeys or switching from one to another depending on what is most relevant to them at that point in time.

Customer journeys give you a helpful mental model and allow you to influence the customer experience while remaining true to the Next-Best-Action paradigm. Instead of scripting the entire customer experience offer-by-offer, you can add multiple journeys and stages with actions to your system and let AI leverage real-time data to determine which journey or action in a stage is most relevant to the customer at that time.

You can apply customer journeys to multiple business issues, for example:

- Periodic check-ins during the onboarding period. You can have an initial welcome stage, followed by a five-day check stage, and then finally, a 30-day check stage.

- Familiarizing and leading the customer to a new mortgage. In this journey, we first raise awareness about mortgages, and then once familiar with the concept, we invite the customer to explore various mortgage offers. Finally, once engaged in the explore phase, we can provide an advisor to help the customer to develop a detailed mortgage offer.

Customers can be a part of many journeys, which are continuously prioritized. Customers can be in one stage of each of given journey, and then progress through the stages sequentially. The system ensures that the customer receives the most relevant action, even if an action is not a part of any journey, which means the actual customer journey might look very different from what you originally had in mind.

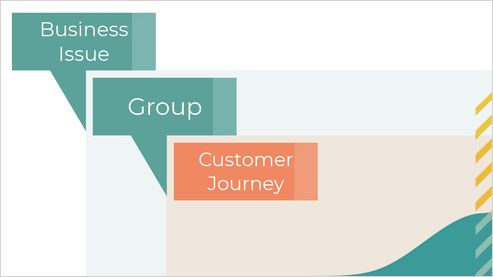

You define customer journeys through Next-Best-Action Designer. There, you can define a customer journey and the business issue and group that it will be nested under, which means that this journey inherits the Engagement Policies of that business issue and group.

You can also set your journey to cover all issues and all groups for a broader scope of actions.

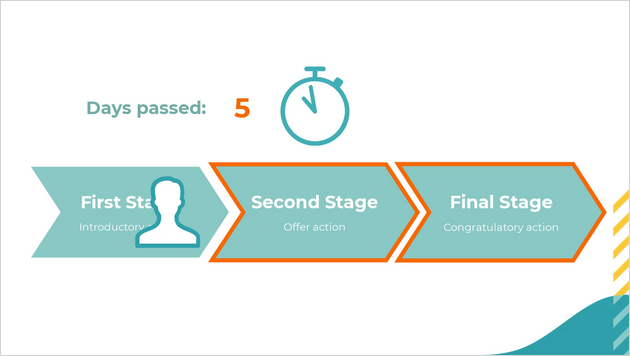

After setting up the journey, you define the number of stages and their names. The customer will progress through these stages in a sequential order. You then add relevant actions to each stage. The actions that you have added come with their available treatments. Customers in each stage see and interact with these actions, and the system recognizes these actions as a part of a particular stage in a customer journey.

If you add an action to a customer journey, you can decide if you present the action as only part of the journey, or both as a part of the journey and as a standalone action. The system records interactions for the action separately.

Before customer progresses from one stage to another, they need to satisfy the entry criteria of the next stage. It is not recommended to use very rigid entry criteria with multiple conditions, as the AI can guide the customer through different journeys and standalone actions.

Entry criteria can be as simple as 30 days passing since the customer has joined the bank and as complex as a customer having engaged with a set of mortgage offers in the last week, showing interest in talking to an advisor.

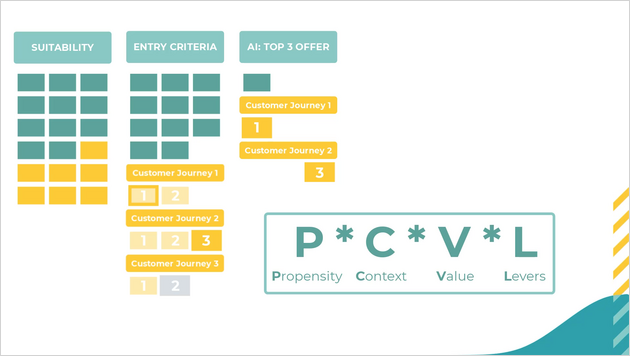

Take a look at an example of how entry criteria work and where they start to take effect in the prioritization. Say your system has 30 actions, and it is time to present the best three of them to a particular customer. The 12 orange actions are a part of various customer journeys.

First, the system applies the standard engagement policies. Consequently, the eligibility, applicability, and suitability policies of the business issue, group, and actions are applied, which leaves us with 18 actions, out of which, seven are part of various customer journeys.

Now let's expand to see that the customer journey actions are a part of different journeys, and that each action is a part of a different stage. As you can see, different actions are relevant for the customer in the various stages due to the entry criteria set up by the Decisioning Architect. In this example, the customer:

- Passes the entry criteria to the first stage in the first journey

- Is in the third stage of the second journey, and it passes its entry criteria

- Is in the second stage of the third journey, but it does not pass its entry criteria

From the seven actions, which progressed through the suitability and are part of a journey, the customer actually qualifies for only the two highlighted actions.

At this point, AI selects among the 13 actions the best three actions to show to the customer based on the PCVL calculation (propensity * context * value * levers).

In summary, each component of the policy filters the initial set of 30 actions:

- 24 eligible

- 21 applicable

- 18 suitable

From the 18 suitable actions, 11 are standalone, not part of any journey and two actions from the remaining seven pass the entry criteria from the various journeys and stages defined. The remaining 13 actions, which pass the conditions are prioritized by the AI, and then, the best three are selected. The selected actions can be one of the standalone actions, an action from a journey, or an action from a journey that is already in progress.

Customer journeys can influence the PCVL formula in two ways.

The first way to influence the propensity occurs passively as you add customer journeys to your system. Customer journeys come with predictors that begin to function as your customers interact with the journeys that you have designed for them. These predictors will influence the propensity directly.

The second way is to use stage upweighting. Stage upweighting applies a numerical upweight value to actions in that stage and is used to increase or decrease actions promotion level. You can apply it to any stage, and it is a part of the Business levers in the Arbitration.

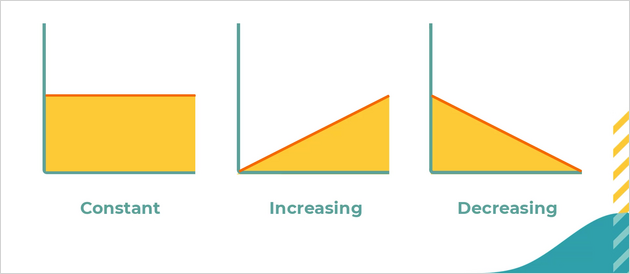

Upweighting can be constant, increasing or decreasing over time. For example, you might want to upweight actions of a stage for the first 10 days that the customer is in this new stage. During the first 10 days, the upweight will decrease steadily to avoid annoying the customer with a single offer.

In summary, customer journeys provide a good mental model for managing content and influencing next-best-action decisions to present suitable actions seamlessly for your customers.

This Topic is available in the following Modules:

Want to help us improve this content?